Products

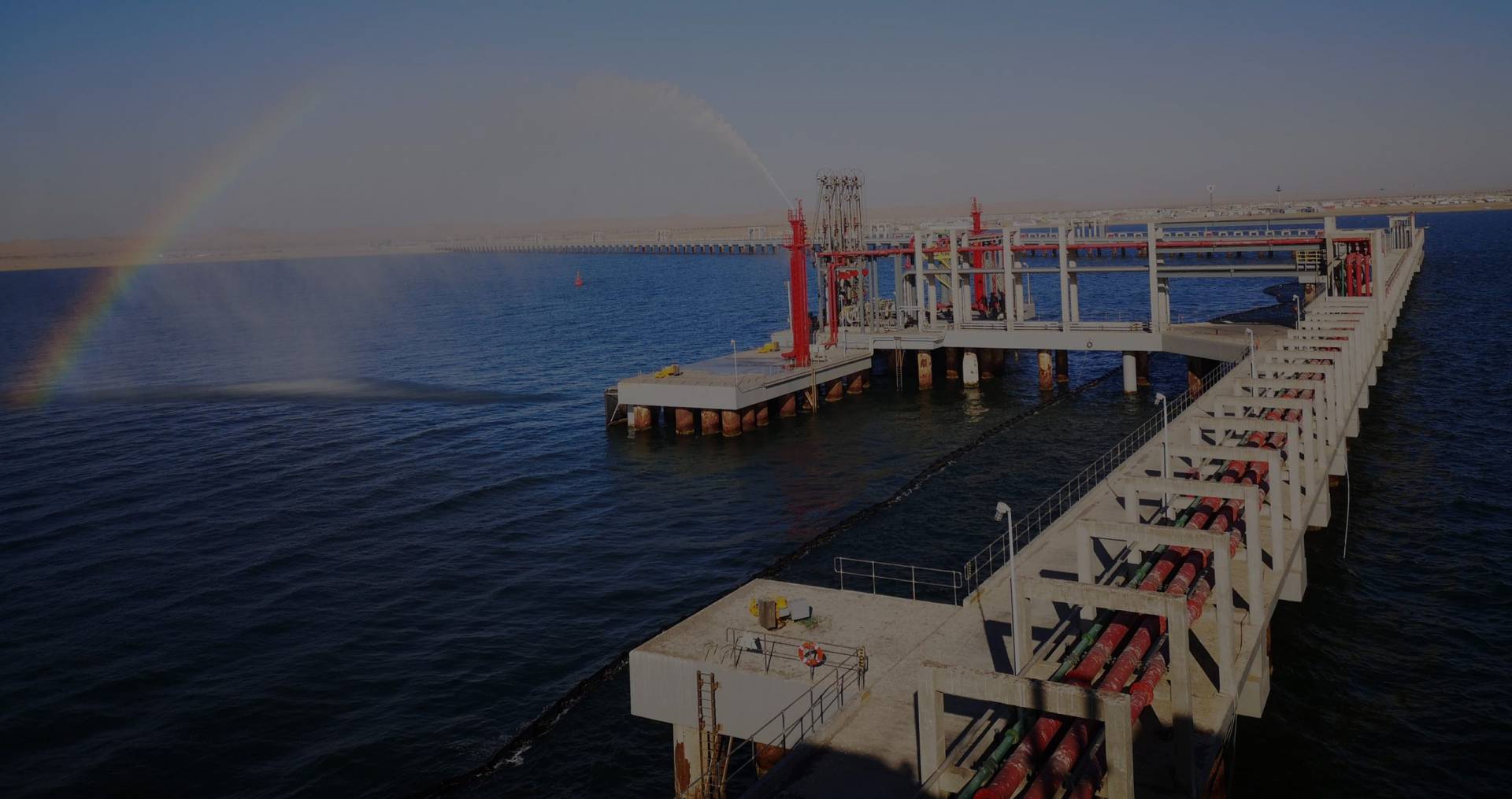

Upstream Activities

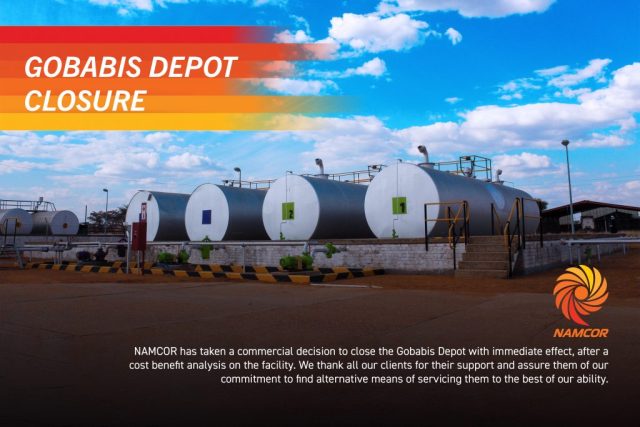

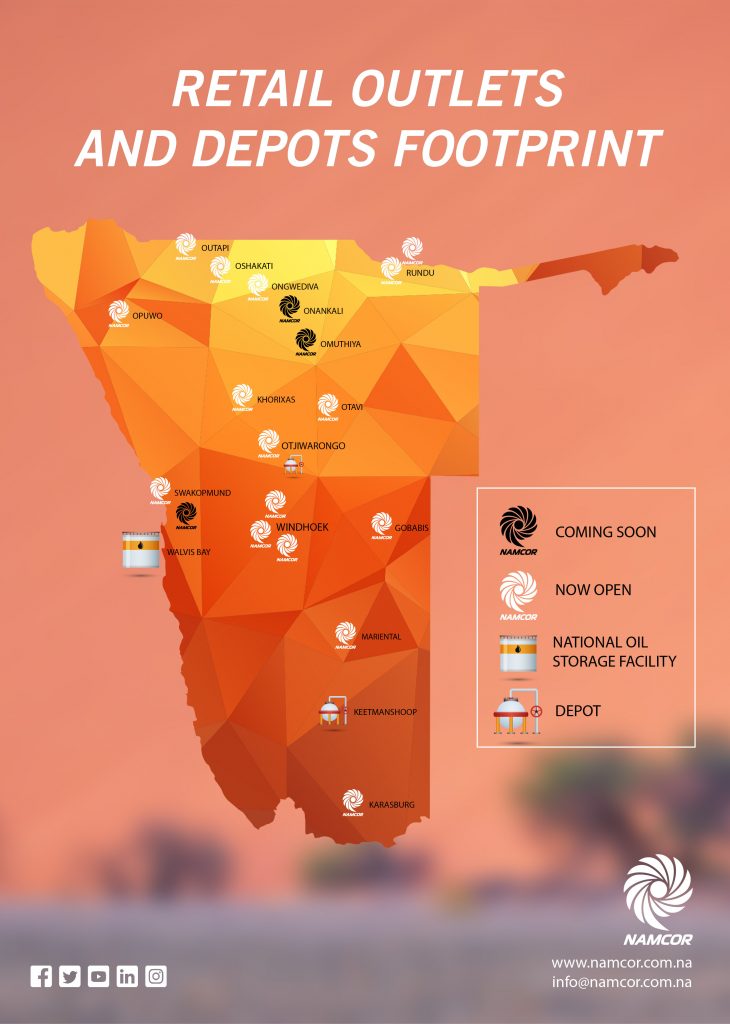

Downstream Activities

SSHEQ

Products

We source quality petroleum products at competitive prices, ensuring local and international supply.

Upstream Activities

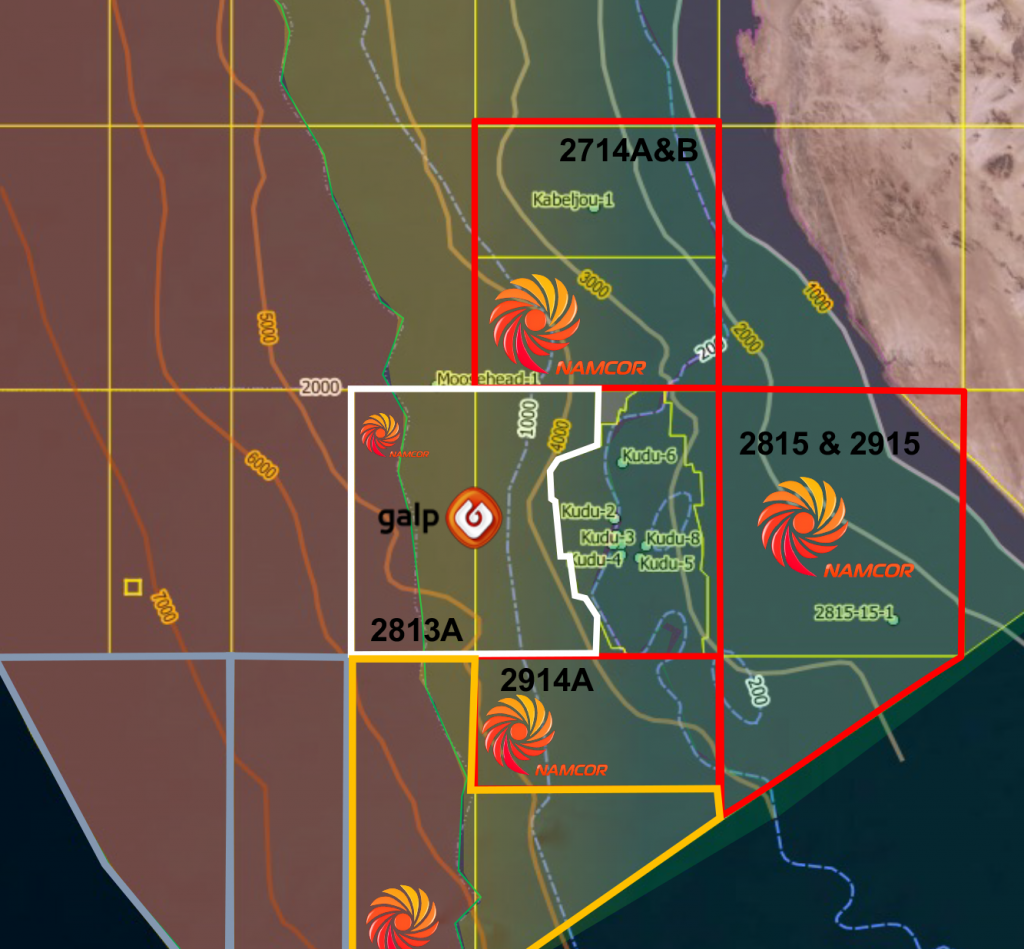

We actively market and promote the hydrocarbon potential of the Namibian acreage.

Downstream Activities

We go the extra mile, exceeding customer expectations in providing quality lubricant and petroleum products.

SSHEQ

We strive to proactively ensure the safety of all our operations, products, services, and staff.

1 US$ = N$ 0

Currency Exchange Rate

1 £ = N$ 0

Currency Exchange Rate

1 € = N$ 0

Currency Exchange Rate

N$22.30

Unleaded Petrol

N$21.97

Diesel 10ppm

N$21.77

Diesel 50ppm